布団セット 和タイプ8点(厚い敷布団15cm) セミダブルサイズ 色-ミッドナイトブルー /シンサレート高機能中綿素材 暖かい

(税込) 送料込み

商品の説明

商品説明

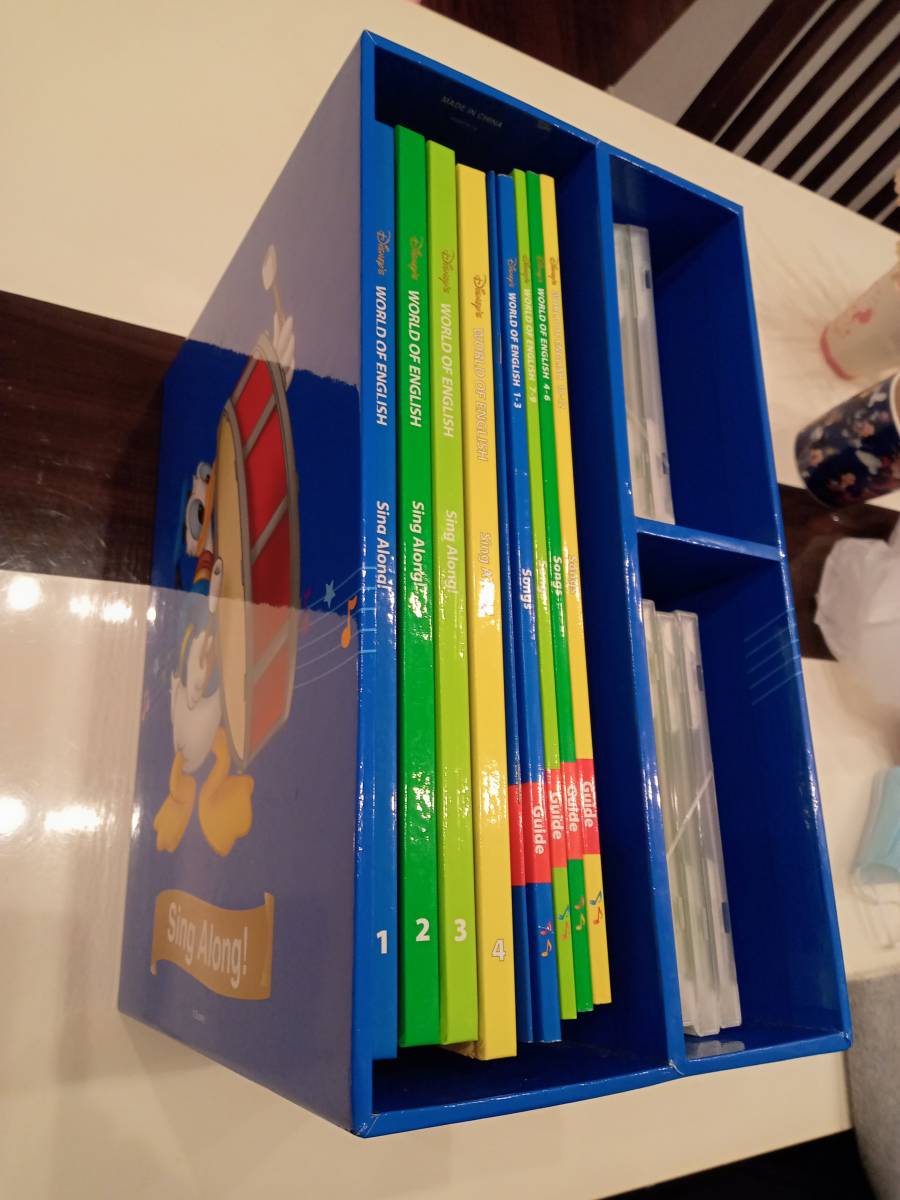

| 出品番号#38777 こちらの出品商品は、 布団セット 和タイプ8点(プレミアム敷布団の厚さ15cmタイプ) セミダブル サイズ [色:ミッドナイトブルー] です。 |

| ☆同じ商品シリーズの一覧は こちらです。 |

| ★商品リンク★ |

| *☆*~+~*☆*~+~*☆* 同じ商品シリーズ ☆同じ商品シリーズの一覧は こちらです。 |

| *☆*~+~*☆*~+~*☆* 布団カバーセット(ベッドタイプ) シングル | セミダブル | ダブル | クイーン | キング | その他 布団カバーセット(和タイプ) シングル | セミダブル | ダブル | クイーン | キング |

| *☆*~+~*☆*~+~*☆* 掛け布団カバー シングル | セミダブル | ダブル | クイーン | キング ボックスシーツ シングル | セミダブル | ダブル | クイーン | キング | その他 敷布団カバー シングル | セミダブル | ダブル 枕カバー 枕カバー |

| *☆*~+~*☆*~+~*☆* 敷パッド シングル | セミダブル | ダブル | クイーン | キング | その他 敷パッド一体型ボックスシーツ シングル | セミダブル | ダブル | クイーン | キング | その他 |

| *☆*~+~*☆*~+~*☆* 毛布、タオルケット、肌掛け シングル | セミダブル | ダブル | クイーン | キング 掛け布団 シングル | セミダブル | ダブル | クイーン | キング |

| *☆*~+~*☆*~+~*☆* 布団セット(ベッドタイプ) シングル | セミダブル | ダブル | クイーン | キング 布団セット(和タイプ) シングル | セミダブル | ダブル | クイーン | キング 布団セット(ボリューム和タイプ) シングル | セミダブル | ダブル |

| *☆*~+~*☆*~+~*☆* マットレス シングル | セミダブル | ダブル | クイーン | キング | その他 脚付きマットレスベッド(ボンネルコイル) セミシングル | シングル | セミダブル | ダブル | クイーン | キング | その他 脚付きマットレスベッド(ポケットコイル) セミシングル | シングル | セミダブル | ダブル | クイーン | キング | その他 脚付きマットレスベッド(国産ポケットコイル) セミシングル | シングル | セミダブル |

| *☆*~+~*☆*~+~*☆* ベッド(引き出し付き) シングル | セミダブル | ダブル | ワイドキング(2台の連結) ベッド(ロー、フロア) セミシングル | シングル | セミダブル | ダブル | クイーン | キング | ワイドキング(2台の連結) ベッド(その他) セミシングル | シングル | セミダブル | ダブル | クイーン | キング |

| *☆*~+~*☆*~+~*☆* ドレープカーテン 幅100cm×高さ200cm未満 | 幅100cm×高さ200cm以上 | 幅150cm×高さ200cm未満 | 幅150cm×高さ200cm以上 | 幅200cm×高さ200cm未満 | 幅200cm×高さ200cm以上 レースカーテン 幅100cm×高さ200cm未満 | 幅100cm×高さ200cm以上 | 幅150cm×高さ200cm未満 | 幅150cm×高さ200cm以上 | 幅200cm×高さ200cm未満 | 幅200cm×高さ200cm以上 |

| *☆*~+~*☆*~+~*☆* ラグ、マット 45cmから(短辺) | 70cmから(短辺) | 100cmから(短辺) | 140cmから(短辺) | 200cmから(短辺) | 正方形 |形 | タイルカーペット |

| ★出品商品★ |

| *☆*~+~*☆*~+~*☆* こちらの出品商品は、 布団セット 和タイプ8点(プレミアム敷布団の厚さ15cmタイプ) セミダブル サイズ [色:ミッドナイトブルー] です。 【商品の状態】 こちらの商品は、新品です。 【出荷目安】 ご注文後の 1 から 2営業日後(土日祝日を除く)。 【配送日数】 2日前後から。 北海道は3日前後から。 沖縄県と離島は1週間前後から。 【配送会社】 佐川急便 【お届け希望時間帯】 午前、12時-14時、14時-16時、16時-18時、18時-20時、19時-21時。 【基本送料】 送料無料 【別途送料地域】 北海道、沖縄県、離島。 ※配送内容は変更になる場合がございます。 |

こちらの商品を気になっていただけましたら

ぜひ、ウオッチ★をお願いいたします。m(u_u)m

23510円布団セット 和タイプ8点(厚い敷布団15cm) セミダブルサイズ 色-ミッドナイトブルー /シンサレート高機能中綿素材 暖かい住まい、インテリア家庭用品

商品の情報

カテゴリー

配送料の負担

送料込み(出品者負担)配送の方法

ゆうゆうメルカリ便発送元の地域

宮城県発送までの日数

1~2日で発送メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています